Stay Safe Online: You’re More Vulnerable Than You Think

Your Personal Information is Exposed and Available to Fraudsters

Everyone seems to be paying close attention to cyber security these days. Even still, the seemingly constant stream of high-profile data breaches making news headlines suggests that we are always a step behind the criminals.

However, are consumers putting too much emphasis on certain aspects of online security while leaving other avenues vulnerable? Is it even possible to stay safe online?

Americans Apprehensive About Sharing Information

American consumers are generally anxious about the information they share. A poll conducted last year reports that 91% of Americans feel they’ve lost control over the way in which companies collect and use their personal information. The same poll suggests that the majority of people have little faith in the security of communication lines including cell phones, texts, emails and social media.

Despite Americans’ concerns, fraud is not going away. Although consumers are most worried about the information they hand over to companies, it is the information they hand over to strangers which might be a bigger problem.

An Old Phone Could Be a Fraudster’s Best Friend

You might think twice about how you handle your electronic devices. Reporters for ITV Wales conducted a little experiment recently, generating some startling results.

The team bought a handful of second-hand phones, then turned them over to a computer forensics lab at the University of South Wales for analysis. As researcher Gareth Davies explains:

- “We found the previous user of one of the devices’ full name, address, date of birth, all of the contacts so we know who they are friends with, who their family are. Their home address, their GPS locations, all their pictures on the device, all their text message conversations, which resulted in us ultimately finding online user accounts, user names and passwords, and credit or debit card details and it also seemed like potentially this person had been a victim of fraud in the past.”

Any criminal who had purchased the phone in question and had even a little training or experience in computer forensics could have easily stolen the individual’s information. What this suggests is that, while consumers might be preoccupied with their personal security in certain regards and how to stay safe online, they leave other areas widely vulnerable.

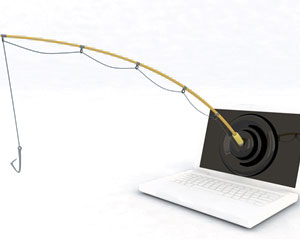

Phishing Continues to Grow

Phishing remains one of the most popular methods for criminals looking to steal cardholders’ information. This is a technique by which a criminal will masquerade as a legitimate or trusted entity, only to install malware, steal cardholder information or otherwise compromise the user’s security.

One phishing campaign currently circulating around the internet relies on tricking consumers into allowing malware onto their computers for criminals to collect personal information.

One phishing campaign currently circulating around the internet relies on tricking consumers into allowing malware onto their computers for criminals to collect personal information.

After receiving a seemingly legitimate email from FedEx, the customer is told that they have a package awaiting pickup, and are pressured into downloading an attachment to verify their identity. In reality, the attachment is actually malware, designed to steal the user’s information.

While this attack is popular at the moment, criminals invent new phishing campaigns on a near-constant basis.

Protecting Yourself

With threats seemingly around every corner, what can consumers do to protect and defend themselves against being victimized in the digital world? Here are just a few habits which can help you stay safe online:

Avoiding Phishing Sites

Fraudsters design phishing sites specifically to create a convincing copy of a real website. However, there are usually clues which should register as suspicious. For example, if the site design feels just a bit cheap or “knockoff”-ish, the URL doesn’t seem quite right, or if it asks you for specific personal information, it may be a fake.

Use Unique Passwords

Do not reuse the same password to access your email account, your social media accounts and your bank account; instead, come up with unique passwords for each site. You can even take advantage of a password manager to help you keep it all straight.

Monitor Your Bank and Credit Statements

The best way to know if any suspicious activity turns up with your account is to monitor your account. Sign-in regularly and double check your statements. Many financial institutions also offer to send alerts for unusual or suspicious activity for added security monitoring.

Do Not Conduct Business on Public Networks

If you need to conduct any personal or financial business online, do so only from your own private connection. Crafty fraudsters can hijack any information sent via public WiFi.

Keep an Eye On Your Devices

We bring our phones and tablets with us everywhere. A lot of us conduct most, if not all, of our online business and interactions via mobile devices, which is why it is especially important to keep any eye on these items.

Secure your lock screen with a passcode, and never save passwords for financial/personal profiles or credit card information using browser cookies. Enter them in yourself every time. Also, be sure all of your personal info is wiped completely before selling or trading-in your phone.

I Don’t Recognize This Transaction!

If you find suspicious or clearly fraudulent activity on your bank or credit card statement, contact your financial institution immediately for assistance. You should also contact the three major credit reporting bureaus—Equifax, TransUnion and Experian—and inform them of the incident to protect your credit score.

If, however, you find isolated transactions you don’t recognize, but which you are not certain are fraudulent—don’t panic. While your first instinct may be to call the bank and demand a chargeback for fraudulent activity, in most cases the explanation is actually much less frightening.

Confusing statement identifiers, delayed authorizations or backordered merchandise can oftentimes give the wrong impression when they show up in your financial records. However, ordering an unjustified chargeback means that your money could be tied up for months during the dispute process, and if you lose the dispute, it could reflect negatively on your credit score.

Contact eConsumer Services® instead—our service provides faster resolution, better outcomes, safeguards your credit score and helps you stay safe online.