9 Things You Never Knew Could Destroy Your Credit Score

Deadly Consumer Actions are Destroying Your Credit Score

The simplest actions can make or break your credit score. In fact, there are several things you’re probably doing which will cause your rating to slowly dwindle until your reputation is absolutely destroyed.

We’re not talking about the obvious issues that everyone is familiar with—back taxes, foreclosure, late payments, etc. We’re talking about the seemingly innocent actions consumers take all the time.

Want to know all those nasty little habits that are tanking your credit score?

Who Cares?!

First off, you need to understand the importance of maintaining a healthy credit score.

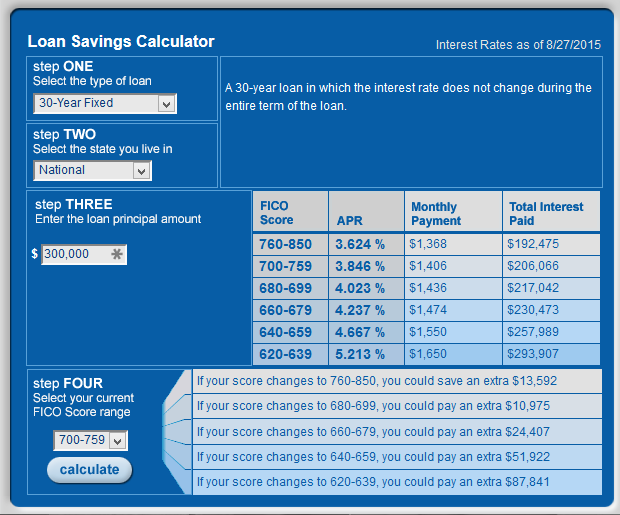

The higher the score, the better interest rates and credit opportunities you’ll have. On the other hand, a low score could mean you’re unable to obtain new credit cards, loans or other lines of credit.

Check it out. If your credit score drops just one point it could put you in a different FICO category. That one point could cost you tens of thousands of dollars.

Imagine what would happen if you commit one or more of these sins, dropping your credit score like a rock?!

Destructive Behavior #1: Having a Large Balance…Even If You Pay It Off

Many consumers falsely believe it doesn’t matter how much credit they have, as long as they pay the bill on time. However, your credit utilization ratio is the second most powerful credit score influencer (timing of payments is the first).

What is a credit utilization ratio? It is the percentage of available credit that is currently in use. For example, if you have a credit card with a $5,000 limit that currently has a balance of $2,500, your credit utilization ratio is 50%. Credit utilization is based on both individual lines of credit and overall availability.

Some financial “experts” will tell you any credit utilization ratio below fifty percent is fine. In reality, it needs to be between ten and thirty percent. Those with the absolute best credit score have an average credit utilization ratio of just seven percent.

Here’s the kicker: even if you pay the credit card bill the moment it arrives in the mail, the damage has already been done. Banks report credit utilization on the day the bill is issued.

Here’s what you need to know if you want to keep your score from tanking:

- Don’t run up a big debt on a single card (regardless of how many rewards you could earn). Spread the expense out over several cards.

- Go online and pay the balance before the closing date. Don’t wait until the bill is issued.

Destructive Behavior #2: Not Taking Your Spouse Into Consideration

Yes, it is true everyone has their own credit score. Under normal circumstances, your spouse’s financial activity won’t affect you—unless you bind the two of you together.

If you have joint accounts or co-sign on loans and your spouse flakes, you’ll suffer the consequences. If you are both listed on the account, you’ll both damage your credit score if things get ugly.

On the other hand, it isn’t wise to put all the accounts in one person’s name. Doing this leaves a huge gap in credit history for the other spouse. The credit score for one spouse will soar while the other dwindles. In situations of divorce or death, it could be difficult for the inactive spouse to get new credit.

Destructive Behavior #3: Quitting Cold Turkey

Many people who struggle to manage debt think it’s best to eliminate all temptation and do away with credit cards. This could help you decrease your debt, but if not done properly, the action could also decrease your credit score.

If you don’t have open lines of credit, there is nothing to score.

Destructive Behavior #4: Closing Inactive Accounts

You don’t use that account. Why bother keeping it open?

Here’s why. If you close your accounts:

- You’ll make your credit utilization ratio skyrocket. One card has a credit limit of $5,000 and you’ve used $2,500. You close the other card that has a limit of $3,000. In one fell swoop, you’ve increased your credit utilization from a respectable 30% to a dangerous 50%.

- The average age of your accounts will decrease. The older your credit history, the better. If you close the account that’s been open for five years and just have the three year old account, your credit history will only be three years old. Short credit histories don’t give loan officers enough activity to evaluate.

Destructive Behavior #5: Filing Illegitimate Chargebacks

Do you know what a chargeback is? Maybe you’ve heard it called a transaction dispute or a bank-issued refund. Regardless of what you call it, a chargeback can be a catch-22.

Technically, a chargeback is a form of consumer protection. If your credit card is involved in fraud (a criminal made an unauthorized purchase or a merchant took advantage of you), you aren’t legally responsible for the charge.

However, if you abuse the chargeback system, the consumer protection mechanism turns into a deadly weapon. If you falsely claim fraud and file a chargeback instead of getting a refund from the merchant, the practice is called friendly fraud. And friendly fraud is essentially cyber shoplifting.

If you want a refund, contact eConsumer Services®. We’ll get your money back.

Don’t file an illegitimate chargeback, one based on false claims simply because it seems like an easier option than a refund.

If the bank learns you are engaging in friendly fraud, your account is likely to be closed. And as you just read, a closed account negatively affects your credit score.

[Tweet “You’ll never believe how easy it is to destroy your credit. Number 5 was a shocker!”]

Destructive Behavior #6: Opening Several Accounts at Once

Every time you apply for a new line of credit, the lender must conduct a hard inquiry to check your credit history. And, you guessed it, a hard inquiry negatively impacts your credit score.

Eventually, your credit score will rebound after the hard inquiry, but not if you make several in a short period of time.

Plus, if you are always adding new accounts (and then closing them later), you’ll never build up a solid credit history.

Destructive Behavior #7: Not Reporting a Name Change

Did you get married? Divorced? Change your name to Princess Consuela Bananahammock? You need to let your creditors know.

Documents that are part of your credit history and woven into your report are exceedingly diverse. Many of these contributing factors don’t contain your social security number and are filed based on your name alone.

If you don’t report a name change, all those good deeds you’re doing to raise your credit score won’t do their job.

Destructive Behavior #8: Not Finding and Reporting Errors

Studies have found one in four credit reports contain an error that negatively impacts the consumer’s score.

Everyone is entitled to one free credit report per reporting bureau each year. There are three different reporting agencies, meaning you could check your status every four months.

Don’t assume everything is kosher. Get your free copies and keep an eye on things. Report and fix any errors, especially those that are damaging your reputation.

Destructive Behavior #9: Co-Signing On Someone Else’s Credit

We saved the worst for last.

Do you know why people need a co-signer? Because they have terrible credit. Do you know what happens to the co-signer if history repeats itself for the primary debtor? The co-signer has to pick up the slack or suffer the consequences.

If the debtor makes late payments or carries a high balance, your credit score will suffer. Your name is on the line of credit too, and you are just as responsible—even if you aren’t a direct beneficiary.

If someone asks you to co-sign (even friends and family), just say no!

[Tweet “Want to know all those nasty little habits that are tanking your credit score? Here they are.”]

Your credit score is extremely valuable. Don’t allow these seemingly innocent behaviors to destroy your financial stability.