What is a Card Verification Value (CVV)?

A card verification value, often referred to as a “CVV,” is a three or four-digit security code printed on credit and debit cards. The code is designed to enhance the security of card-not-present transactions, such as online purchases.

Your CVV provides an additional layer of verification for transactions when you can’t physically provide your card to the seller. It helps confirm that the person making the transaction is probably in possession of the actual card.

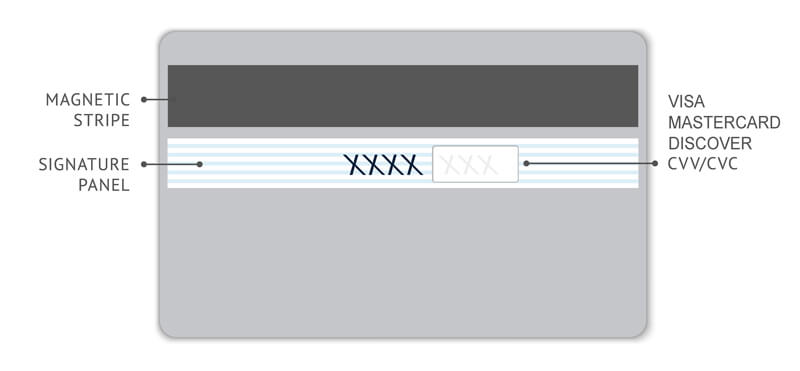

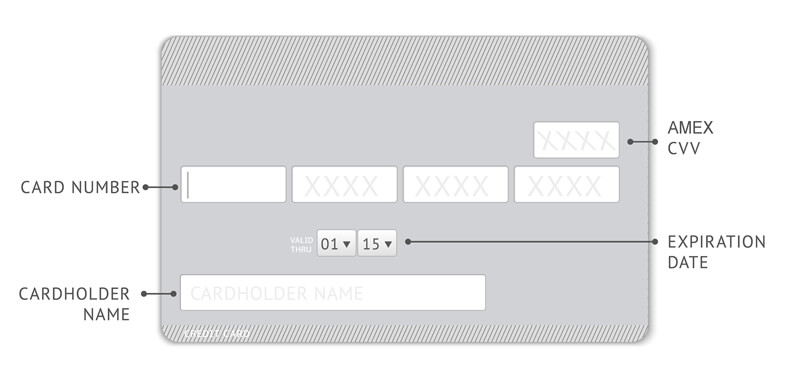

For Visa, Mastercard, and Discover cards, the CVV is a three-digit number found on the back of the card, near the signature box. For American Express cards, the CVV is a four-digit number on the front of the card.

By requiring this code, merchants can reduce the risk of fraud and unauthorized transactions. It ensures that even if someone has access to the card number, they still need the CVV to complete a purchase.

How Do Card Verification Values Work?

Card verification values work by acting as an additional verification step during transactions, especially in environments where the physical card is not present.

When a consumer initiates an online purchase, they are prompted to enter their CVV along with their card number and expiration date. This request sends the CVV to the payment processor, who forwards it to your issuing bank.

The bank checks the code against the corresponding card details stored in their secure database. If the CVV matches, it confirms that the customer has the physical card in hand, as this code should not be easily accessible to others without the card.

This verification process helps to mitigate potential fraud by ensuring that even if a thief gains access to a card number, they cannot make a transaction without also having the CVV.

Are CVVs Effective at Stopping Fraud?

Card verification values are a significant tool in the fight against credit and debit card fraud. They are not foolproof, though. Their effectiveness lies in the added security layer they provide during online transactions.

By requiring the CVV along with the card number and expiration date, merchants can significantly reduce the likelihood of unauthorized transactions, as the CVV is not typically stored or easily accessible. However, savvy fraudsters may still find ways to obtain CVV codes through data breaches or phishing schemes.

Additionally, since CVVs can only verify that a customer has the physical card at the time of a purchase, they do not prevent all forms of fraud, particularly when accounts are compromised through other means. Overall, while CVVs enhance security, they should be part of a broader strategy that includes robust authentication measures and consumer education to effectively combat fraud.

How to Keep Your CVV Secure

You should adopt several best practices to keep your card verification value secure. We recommend that you:

Keep Your Info To Yourself

Never share your CVV with anyone, especially through email or over the phone. Legitimate businesses typically do not ask for this information unless processed during a transaction.

Avoid Storing Payment Info

Be cautious about storing card details on websites. Whenever possible, opt for payment methods that do not require saving card information.

Be Wary of Unfamiliar Sites

Using secure and trusted payment platforms can provide extra layers of protection. If a site seems suspicious, it’s best to trust your gut and avoid it.

Keep Tabs On Your Bank Activity

Regularly monitor account statements for any unauthorized transactions. Report suspicious activity to your card issuer immediately.

Get Educated

Educating yourself about common phishing tactics can help you avoid falling victim to scams designed to steal sensitive information, including CVVs.