What are QR Code Payments?

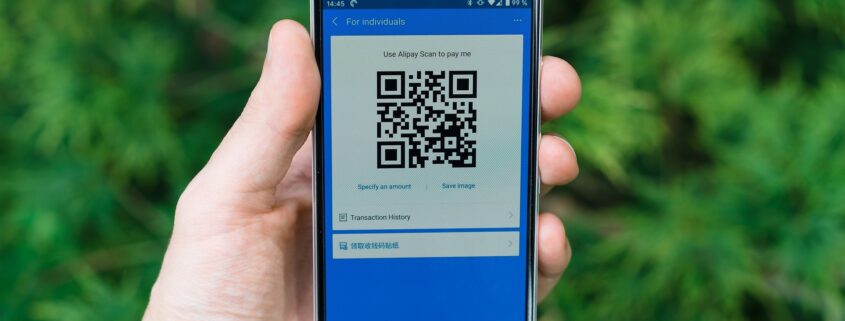

Have you visited a restaurant that asks you to point your smartphone at a QR pattern to view their full menu? Pointing your camera at the QR code makes the restaurant’s website pop up in your browser, and some even allow you to order directly from your phone. Easy enough, right?

Read more →